Wall Street closed higher following news of a tariff truce between the United States and China, signalling a temporary easing in their prolonged trade tensions. The agreement, announced on 12 May 2025, involves a mutual freeze on the introduction of new tariffs, providing a window for further negotiations. This development sparked optimism among investors, lifting major US stock indices in a session marked by improved market sentiment.

The truce comes after months of intensified discussions and heightened uncertainty surrounding growing inflation and slowing global growth. The US and China agreed to hold off on additional tariff measures while continuing to address core issues, including intellectual property protections and fair trade practices. Market analysts noted that the respite could stabilise supply chains and reduce costs for multinational companies caught in the crossfire.

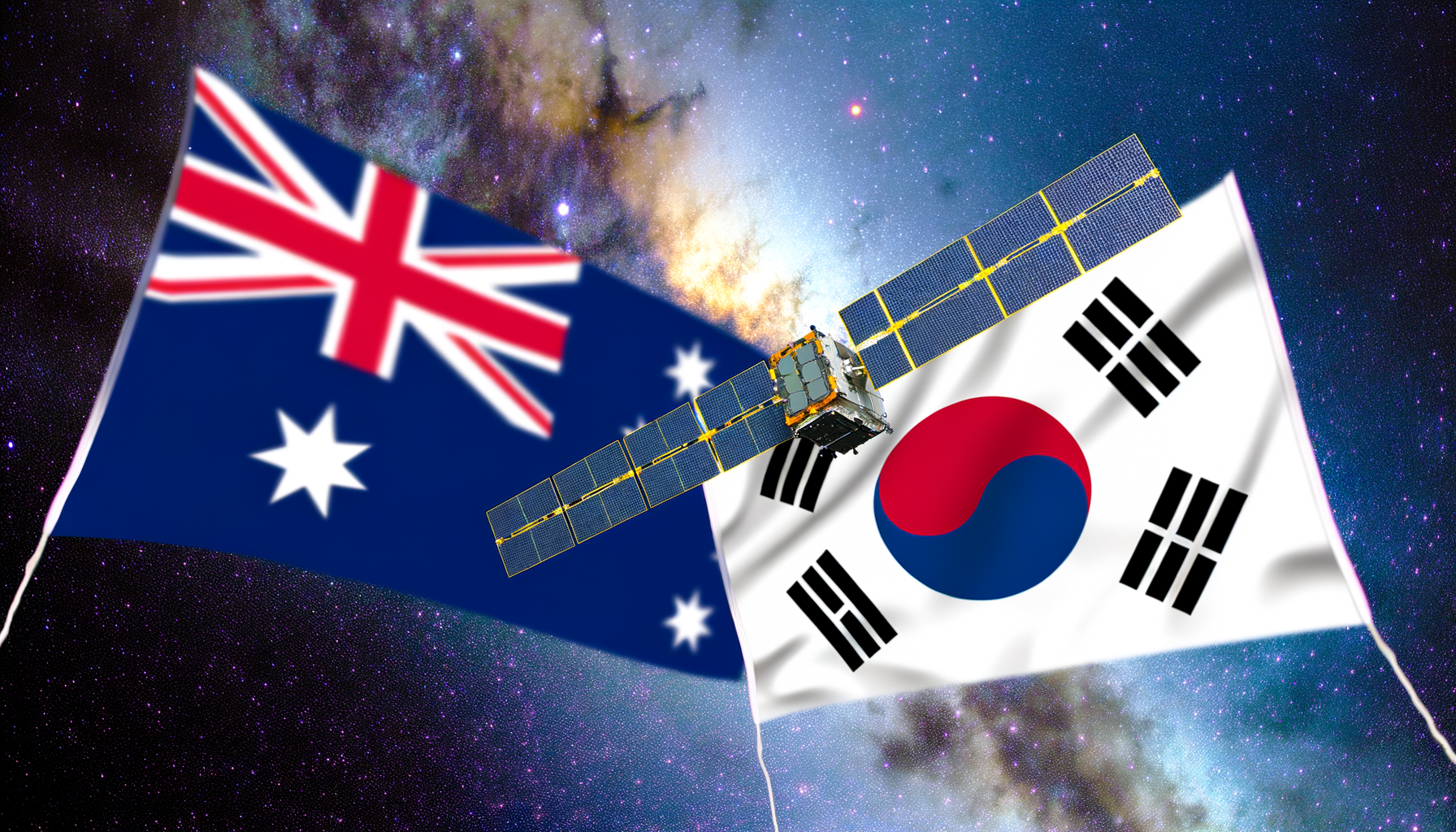

Despite this positive step, experts caution that the tariff truce is a temporary measure rather than a comprehensive resolution. Fundamental disagreements remain, and tensions are likely to persist. For Australia, this truce offers some relief given its deep economic ties to China and the US, potentially easing pressure on commodity exports and currency volatility.

Looking ahead, investors and policymakers will closely monitor whether these talks translate into substantive progress or merely delay further confrontations. The outcome will significantly influence global trade dynamics and economic prospects within the Indo-Pacific region.

Context & Background

The United States and China have long been engaged in complex trade negotiations affecting global markets. Since the onset of their trade war in 2018, both countries imposed tariffs on hundreds of billions of dollars worth of goods, disrupting supply chains and impacting businesses worldwide, including in Australia. Tariffs are taxes on imports designed to protect domestic industries but often lead to increased costs for consumers and exporters alike.

Efforts to ease tensions through negotiations and temporary truces have periodically lifted investor confidence, leading to market gains. However, deep structural issues such as intellectual property rights, technology transfers, and geopolitical competition continue to challenge a durable agreement. The most recent tariff truce follows months of dialogue amid a backdrop of rising global inflation and uncertain economic growth prospects.

For Australians, the US-China trade relationship is crucial since China is Australia’s largest trading partner, and the US remains a key economic and security ally. Fluctuations in tariffs and trade policies between these superpowers can affect commodity prices, investment flows, and regional stability in the Indo-Pacific.

In This Story

United States

The world’s largest economy, engaged in trade negotiations with China to resolve tariff disputes and protect domestic industries.

China

Major global economic power and Australia’s largest trading partner, involved in ongoing negotiations with the US to manage trade tensions and tariffs.

Wall Street

The financial district of New York City, home to major US stock exchanges where market reactions to global events are closely watched.

Comments are closed.